|

Welcome To Evlithium Best Store For Lithium Iron Phosphate (LiFePO4) Battery |

|

CATL, the pace of buying minerals at home and abroad has not stopped.

In 2022, CATL, whose performance was low before and high after, made a big profit of 30 billion.

On the evening of January 12, CATL released a performance forecast, saying that the net profit attributable to shareholders of listed companies in 2022 is expected to be 29.1 billion to 31.5 billion yuan, an increase of 82.66% to 97.72%; Non-net profit deduction is expected to be between 26.8 billion and 29 billion yuan, with a year-on-year increase of 99.37% to 115.74%.

On the same day, the market share ranking of power battery enterprises was also released. Although the domestic assembly vehicle volume of CATL power batteries ranked first, half of the country did not keep it, and the market share decreased by 3.9 percentage points year-on-year to 48.2%.

Obviously, CATL's fortune password is elsewhere.

The news at the beginning of the year revealed the secret. On December 24th, 2022, in Thuringia, central Germany, CATL's first overseas factory produced the first lithium-ion battery cell as scheduled.

Ten days later, the South Korean organization SNE Research released a report saying that in the first 11 months of 2022, although the domestic market share of CATL declined slightly, the global share increased by nearly 5 percentage points to 37.1%, and the loading volume increased by 101.8%, ranking first in the world in a row.

The power battery leader who actively went out to sea has achieved initial results.

Global Mining

CATL, the pace of buying minerals at home and abroad has not stopped.

On January 11th, CATL threw out a restructuring plan of 6.4 billion yuan to compete for Snowway Mining, a "high-priced lithium mine" in Sichuan.

On the same day, some investors asked questions on the interactive platform about the progress of Yacimientos de Litio Bolivianos cooperation (with YLB) bidding project, but CATL did not give a specific answer on the grounds that "cooperation information belongs to the category of commercial confidentiality".

Bolivia is famous for its "land of the sky" in the Andes - the Uyuni Salt Lake. Uyuni Salt Lake not only has the stunning scenery of "the closest paradise on earth", but also breeds more than half of the lithium metal deposits in the world.

In June last year, the National Radio of Bolivia (NRB) reported that the Bolivian government is currently evaluating six companies to exploit the undeveloped lithium resources in the country. In the end, one or more companies may be selected to cooperate with Yacimientos de Litio Bolivianos (YLB).

The shortlist includes four China companies, among which Brunp, a subsidiary of CATL, the world's largest battery manufacturer, is listed. At that time, Alvaro Arnez, Bolivia's vice minister of high-energy technology, said that a final agreement would be reached before the end of December.

On April 15th last year, CATL announced that Contemporary Brunp Lygend, a subsidiary of its holding subsidiary Brunp, planned to invest in the construction of a power battery industrial chain project in Indonesia.

Total investment of the project does not exceed 5.968 billion US dollars, and the planned construction period is five years. It is jointly built by Pule Times and two Indonesian companies, PT Aneka Tambang Tbk. (hereinafter referred to as ANTAM) and PT Industri Baterai Indonesia (hereinafter referred to as IBI).

The project is divided into six sub-projects, including laterite nickel ore development, pyrometallurgy, hydrometallurgy, battery recovery, ternary cathode materials and ternary battery manufacturing. Except for the nickel mine development project, which is 51% controlled by ANTAM, the other projects are controlled by Puller Times, with a share ratio of 60% or 70%.

According to the conversion of share ratio, the total investment in the above-mentioned projects in Pule era is 3.937 billion US dollars. Among them, the nickel mine development and pyrometallurgical projects involve the equity acquisition of the partners, and the investment amount has not been finalized.

ANTAM is a listed state-owned mining company in Indonesia, and the actual controller is the Ministry of Finance of the Indonesian government. IBI is an investment company established by Indonesia National Oil Company, Indonesia National Power Company and Indonesia National Mining Company, which is specially used for battery production. ANTAM holds a 25% stake in IBI.

Indonesia is rich in nickel resources, has the largest nickel reserves in the world, and is also the largest nickel supplier in the world. According to the data of the United States Geological Survey (USGS), Indonesia's nickel resource reserves currently rank the first in the world, about 21 million tons, accounting for 22% of the world's total. In terms of output, according to the data in 2021, the global nickel output is 2.7 million tons, and the Indonesian output is 1 million tons, accounting for 37%.

CATL said that the above projects are conducive to ensuring the supply of key resources and raw materials upstream of it and its subsidiaries, reducing production costs and promoting the layout of battery recycling industry.

In recent years, with the development of new energy vehicles, the importance of key materials such as lithium, nickel and cobalt has become more and more important.

According to the research of the International Monetary Fund (IMF), a typical battery pack of an electric vehicle needs about 8kg of lithium, 35kg of nickel, 20kg of manganese and 14kg of cobalt. Before the price went up, 35 kg of nickel cost only $896. At current prices, the same amount of nickel will be as high as nearly $3,500.

In fact, for the sake of "supply chain security", CATL laid out mineral resources on a global scale a long time ago, which started the process of buying in buy buy.

As early as March 2018, CATL acquired the controlling right of North American lithium industry by acquiring shares of ST Jean, increasing capital and subscribing for convertible bonds, with a shareholding ratio of 95.21%. In April of the same year, CATL invested 15 million Canadian dollars in North American Nickel Inc. through its subsidiary Canada Times, with a shareholding ratio of 25.38%, and had the right to appoint a director to have a significant impact on it.

In September of the same year, CATL's subsidiaries Brunp(25%), Gemei (36%), Castle Peak Industry (21%), Indonesia Molowali Industrial Park (IMIP)(10%) and Japan Osaka and Industrial Co., Ltd. (8%) signed an agreement to invest 700 million US dollars to set up a company in Indonesia to carry out nickel resource smelting and deep processing, and build a world competitive nickel raw material manufacturing system for new energy power batteries.

According to the data, North American lithium industry holds a mining lease and 19 exploration rights, which are located in the northeast corner of La Corne town. The resources of this project are 33.24 million tons (M+I), with an average lithium oxide grade of 1.19%, a reserve of 17.1 million tons and an average lithium oxide grade of 0.94%. The mining area includes an open pit mine and a processing plant with an annual output of 22,400 tons of battery-grade lithium carbonate.

In September of the following year, CATL invested in Australian lithium mine company Pilbara Minerals(PLS) through its subsidiary CATL (Hong Kong) with a strategy of 263 million yuan, holding 6.97%.

Pilbara, a company listed on the Australian Stock Exchange, was established on January 10, 2005, mainly engaged in the exploration and development of lithium and tantalum mines. In the first half of 2019, its revenue was 42.79 million Australian dollars and its net profit loss was 28.93 million Australian dollars. After the completion of the capital increase, Hong Kong Times became the largest shareholder. At that time, Pilbara planned to expand the total capacity of lithium concentrate to 560,000-580,000 tons in September 2022, and the long-term capacity planning will reach 1 million tons/year.

In September, 2020, CATL once again invested 8.58 million Canadian dollars in Canadian mineral giant Neo Lithium. The main asset of the latter is the 3Q lithium salt lake project in Catamarca province, northwest Argentina. However, Neo Lithium was bought by Zijin Mining for 5 billion yuan in October 2021, which means that CATL's shareholding will also be acquired.

However, in September 2021, CATL found another way to acquire the right to participate in the development of the lithium project Manono located in the Democratic Republic of the Congo by investing in the Australian mineral exploration company AVZ Minerals. At the beginning of November of the same year, Tianyi Lithium, a joint venture of CATL, invested another A $6.2 million in Global Lithium, a listed company in the Australian lithium industry.

According to the data, Manono project is one of the largest lithium resource projects in the world. It is estimated that the lithium resource reserves reach 400 million tons and the lithium oxide grade is 1.65%, which is also at a high level. According to the feasibility report released by AVZ in April 2020, the design capacity of Manono project includes an annual output of 700,000 tons of lithium oxide, with a design life of 20 years.

According to incomplete statistics, CATL has directly or indirectly participated in more than 20 domestic and foreign upstream material enterprises, and has deepened its control over the upstream raw materials of lithium batteries through holding, merger and acquisition, and deep binding.

It is worth mentioning that in September, 2021, CATL also tried to "cut off" Millennial Lithium from its hands and owned two Argentine salt lake projects. However, CATL did not win this battle for lithium mine, and finally Lithium Americas Corp succeeded in "grabbing the order".

So, what is the income from overseas investment in mining?

According to the disclosure of CATL's 2021 financial report, the long-term equity investment of 10.9 billion yuan on CATL's books in 2021, corresponding to the income of equity method accounting is 576 million yuan. Among them, except for the loss in NEO Lithium's investment, other companies have gained profits, and Pilbara Minerals has brought nearly 2.9 billion yuan to CATL.

A month ago, on December 15, 2022, Bloomberg released a message that Ford Motor and CATL were considering building a battery factory in Michigan, USA.

According to Bloomberg quoted people familiar with the matter, the two companies are considering a new ownership structure, in which Ford owns 100% of the factory, including buildings and infrastructure, while CATL is responsible for the operation and owns the battery manufacturing technology.

It is worth noting that on July 21st last year, CATL announced that it would supply two models of Ford in North America with lithium iron phosphate batteries using CTP technology, and both parties would explore business opportunities on a global scale. Ford said that this cooperation can help the company significantly reduce battery costs. It is not clear whether Ford is pushing CATL to build a factory in North America.

It can be seen that CATL is considering how to enter the American market.

In fact, although CATL mainly produces batteries in China for direct export at present, it is an inevitable choice for CATL to open up new incremental markets in the sea.

In December, 2022, CATL's first overseas German factory has started to produce batteries locally. In addition, on August 12th, last year, CATL also announced that the company planned to invest in the construction of the Hungarian era new energy battery industry base project in Debrecen, Hungary, with a total investment of no more than 7.34 billion euros. The project will build a 100GWh power battery system production line, and the total construction period is expected to be no more than 64 months. The first factory building is planned to start construction in 2022 after obtaining relevant approval.

This is the second factory built by CATL in Europe after the German factory, covering an area of 221 hectares. By contrast, the investment amount of the first two phases of CATL's factory in Erford, Thuringen, Germany, was only 240 million euros, and its strategic intention was more obvious.

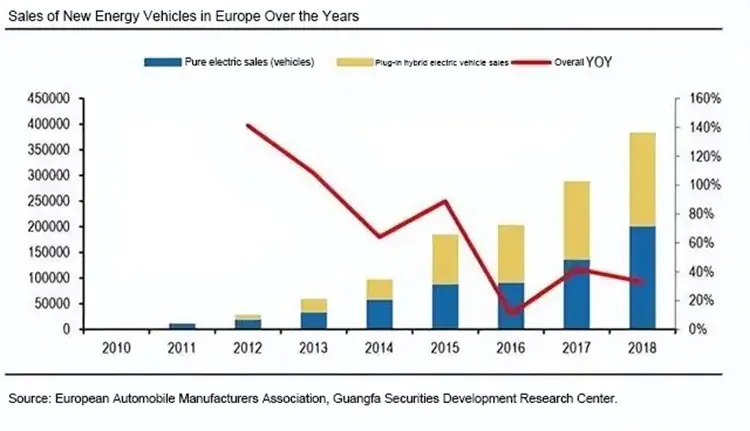

CATL chose to build a factory in Europe in order to catch a ride on the development of new energy vehicles in Europe and America.

In fact, the global market structure of new energy vehicles is changing. GF Securities predicts that under the policy constraints of emission reduction regulations, European automobile enterprises will accelerate the transformation and layout of electric vehicles, and it is expected to realize the production and sales of more than 4 million new energy vehicles by 2025, which will drive the demand for lithium batteries by 135GWh and increase the market space by more than 80 billion yuan, making it the second largest new energy vehicle and lithium battery market outside China.

According to IHS forecast, European electric vehicles will produce more than 4 million cars and trucks in 2025, with a penetration rate of over 20%. In August 2021, the United States clearly stated that by 2030, new energy vehicles will account for half of new car sales.

In this context, the global lithium battery industry chain enterprises have expanded the production capacity layout in Europe to seize the market outbreak dividend. On the one hand, the original leading lithium battery enterprises have entered the market, including LG Chem, SK, Samsung SDI from South Korea, CATL and Farasis Energy from China, and at the same time, they have driven corresponding suppliers to build supporting factories. For example, Umicore of cathode materials, Toray of diaphragm, Capchem of electrolyte and Jiangsu Guotai. On the other hand, emerging lithium battery industry chain enterprises in Europe are also increasing their investment, such as Northvolt of lithium batteries and Daimler's self-built base, and Johnson Matthey of cathode materials.

Liu Yanlong, secretary-general of China Chemical and Physical Power Association, believes that China's batteries and upstream enterprises set up factories in Europe and America mostly to meet the requirements of local customers. Automobile enterprises generally require suppliers to provide supporting facilities nearby to reduce transportation links and logistics uncertainty. China enterprises may lose market opportunities if they don't build factories locally. Since 2020, it has become a trend that China's batteries and upstream enterprises have gone to sea in Europe.

In fact, CATL has been developing overseas customers earlier.

As early as 2012, it began to cooperate with Brilliance BMW to develop the Nuo1e high-voltage battery project, becoming the only battery supplier of BMW in Greater China. In March 2018, Volkswagen and CATL confirmed their cooperative relationship.

Since 2018, CATL has successively assumed the position of supplier of first-tier automobile brands from Europe to Japan, and the process of going to sea has been accelerating. By 2020, CATL will mass-produce high-nickel ternary batteries before its Korean rivals. The anode material of ternary battery is lithium nickel cobalt manganate or lithium nickel cobalt aluminate. The higher the nickel content, the higher the energy density, and the lower the cobalt content, the lower the cost. CATL has achieved a catch-up in the field of ternary batteries.

In the field of lithium iron phosphate batteries, CATL has played a "counterattack" role. In August, 2022, UBS's latest battery disassembly report concluded that lithium iron phosphate batteries have obvious cost advantages and will account for 40% of the global battery market in 2030. This is 25 percentage points higher than the previous forecast.

Overseas investment in the sea has indeed brought a lot of benefits to CATL.

In recent years, the proportion of its overseas revenue is increasing rapidly. Overseas income accounted for 4.37% in 2019, increased to 15.71% in 2020 and reached 21.38% in 2021. In terms of gross profit margin, overseas markets also have obvious advantages. In 2021, the gross profit margin of CATL in China was 25.14%, while that in overseas markets was 30.48%.

Going out to sea to open up new markets is an inevitable choice for CATL, but challenges and competition are everywhere.

First of all, as the global battle for lithium mines intensifies, the road to "grabbing mines" is not smooth sailing. For example, NEO LITHIUM was bought by Zijin Mining for 5 billion yuan in October last year, and CATL's shareholding may be acquired. CATL recently snatched the acquisition right of the Canadian company Millennium Lithium from Ganfeng Lithium, but it was "cut off" by American Lithium at a higher price.

In April last year, CATL announced its investment in Indonesia. During the same period, the Korean consortium led by LG Energy Solution signed a cooperation agreement with Indonesian mining companies Antam and Indonesian Batterey Corporation covering smelting and refining nickel ore, manufacturing precursors, cathode materials and batteries, and assembling finished products.

In addition to fierce competition, there are also changes in the environment.

In 2022, Canada's Ministry of Innovation, Technology and Economic Development issued an announcement, requiring Sinomine (Hong Kong) Rare Metals Resources Co., Limited, Shengze Lithium Industry International Co., Ltd. and Zange Investment (Chengdu) Co., Ltd. to divest or withdraw their equity investments in Canadian lithium mines within 90 days. The reason is that these three investments "threaten Canada's national security and key mineral supply chain".

Less than a week ago, on October 28th, 2022, Minister Champagne and Minister Jonathan Wilkinson of Canada's Natural Resources Department just made a Statement on Strengthening the Protection of Key Mineral Industries from Foreign State-owned Enterprises (hereinafter referred to as the "Statement"), and issued supplementary implementation rules, saying that Major transactions between foreign state-owned enterprises and private enterprises affected by foreign countries in Canada's key mineral areas will only be approved under special circumstances.

A person from a lithium salt company believes that it is difficult for all kinds of China enterprises to pass the Canadian national security review when investing in Canadian lithium mining companies in the future.

Before Canada, Australia has tightened the restrictions on foreign companies investing in lithium mining companies.

Tianyi Lithium Industry, a joint venture between CATL and lithium salt producer Tianhua Chaojing, was stopped by the Australian Foreign Investment Review Board (FIRB) when it tried to acquire a 12% stake in Australian mining company AVZ in 2020. An industry source said that FIRB believed that the investment was "not in Australia's national interest".

In 2020, Australian Senate and House of Representatives revised “Foreign Acquisitions and Takeovers Feeds Imposition Amendment Act 2020” and “Foreign Investment Reform Act”.

The two bills stipulate that overseas entities need to pass FIRB's national security audit when they acquire 10% or more shares of enterprises that affect Australia's national security in Australia. Among them, lithium mine enterprises are clearly listed as "enterprises that affect Australia's national security".

It should be pointed out that although China is the fifth largest lithium resource country in the world, the proven lithium reserves only account for 6% of the world. The world's lithium minerals are very concentrated in geography, and Chile, Australia and Argentina have 78% of the world's lithium resources. The proven reserves of lithium ore in Canada are not high, accounting for only 2.6% of the world, but some Canadian enterprises own minerals in South America and other places.

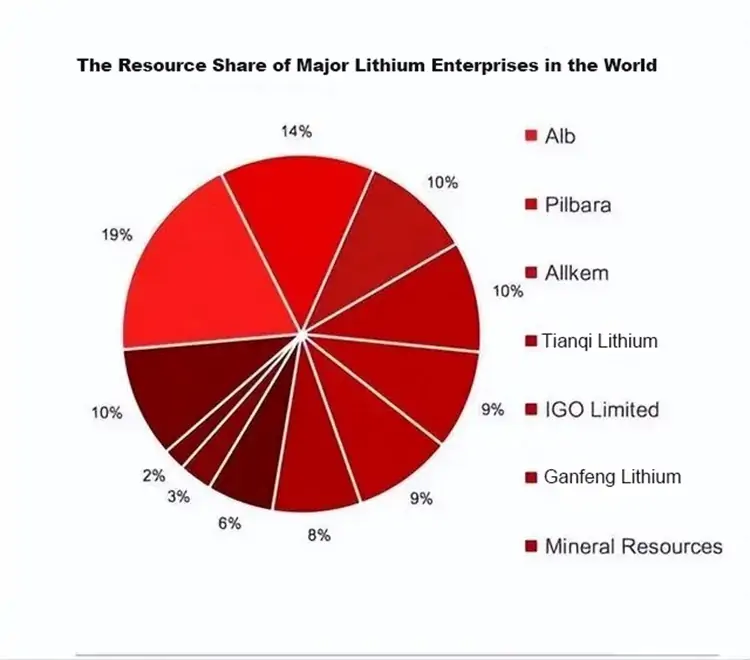

According to Tianqi lithium industry prospectus, 79% of the world's lithium resources are in the hands of seven companies: ALB (USA), Pilbara (Australia), Allkem (Australia), Tianqi Lithium Corporation (China), IGO LImited (Australia), Ganfeng Lithium Industry (China) and Mineral Resources (Australia).

In addition, the South American government is promoting "Lipek" similar to the Organization of Petroleum Exporting Countries. The Argentine Foreign Ministry said in September last year that Argentina, Chile and Bolivia will form an alliance to jointly limit the amount of lithium minerals to control the price of lithium. Indonesia introduced a policy in 2020 to completely ban the export of nickel ore.

Secondly, the competitive environment for building factories in Europe and America is not optimistic.

Europe and America are the base camps of Japanese and Korean enterprises. In January 2022, LG Energay Solution, which ranked second only to CATL in the world, successfully went public and became the largest IPO in Korea. The company raised 12.8 trillion won (US$ 10.6 billion) and became the second largest company with market value in Korea. Its goal is very clear, challenging CATL, and the goal is to nearly double the production capacity by 2025.

At present, LG Energay Solution is backed by LG Group, one of the largest enterprise groups in Korea, and is a battery supplier of major American automobile companies such as Tesla, Ford Motor Company and General Motors.

On August 29 last year, LG Energy Solution signed a contract with Honda Motor Co., Ltd., announcing that it will invest 4.4 billion US dollars to build a 40 GWh battery factory in the United States, and plans to start construction in 2023. SK Securities predicts that by 2025, nearly half of all electric vehicles produced in the United States will use the batteries of LG Energy Solution. In Europe, LG Energy Solution has a Polish factory and is expanding its production capacity. Compared with China car companies and parts companies, Korean companies are more familiar with local laws and regulations and have corresponding talent reserves.

However, in terms of profitability, LG Energy Solution suffered losses in 2019 and 2020. The data shows that its operating profit margin in 2021 was 5.9%, less than half of CATL.

Japanese battery company Panasonic Energy is not far behind. In July, 2022, Panasonic said it planned to spend $4 billion to build a new battery factory in Kansas City, USA. Previously, as the world's fourth largest battery manufacturer for electric vehicles, it has jointly operated a $5 billion factory with Tesla in Nevada, USA.

On the one hand, European and American markets are the base camps of Japanese and Korean enterprises, and CATL faces fierce competition from LG Energy Solution of South Korea and Panasonic of Japan. On the other hand, major European and American countries have plans to support their own battery industry chains.

On August 16th, 2022, US President Biden signed the "Inflation Reduction Act". The bill stipulates that American consumers can enjoy a $7,500 tax credit when buying electric cars, which will be deducted directly from the car price when buying a car. However, the bill requires that vehicles enjoying preferential treatment must be manufactured in North America, and a certain proportion of battery components and raw materials must come from North America or countries that have signed free trade agreements with the United States.

In addition, China enterprises in the supply chain may be regarded as "sensitive entities" facing special restrictions. The US bill requires that battery components and raw materials cannot come from "sensitive entities" from 2024 and 2025.

Gong Min, head of automotive industry research at UBS in China, believes that the above provisions do not directly prohibit vehicles from using China battery components and raw materials, but the lack of vehicle subsidies means that the cost advantages of China battery enterprises will be partially offset, which may indirectly exclude enterprises such as CATL and supply chain from the competition. If China enterprises are regarded as "sensitive entities", it will be even worse.

The European Union has also formulated a special battery bill, which plans to account for the carbon footprint of batteries and upstream supply chain. By 2027, battery products must meet the carbon footprint limit requirements, otherwise they will not be able to enter the European market. The bill also sets clear requirements for the proportion of recycled materials used in batteries. The carbon footprint of battery refers to the total carbon emissions of battery from mineral mining to raw material processing, battery production, transportation and use.

In this regard, in October last year, Bob Galyen, former chief technology officer of CATL, publicly stated during his stay in north american auto show that it was not realistic for the "Inflation Reduction Act" to be completely implemented. The United States did not have a complete upstream and downstream battery supply chain, and the tough measures across the board were unreasonable, which did not fundamentally help to promote the popularization of electric vehicles.

Going to sea is a key leap for China battery enterprises in global competition, but the competitive environment at home and abroad is complex and the road to go is not smooth.

Edit by editor

All Rights reserved © 2025 Evlithium Limited